Loans to buy a retiring business

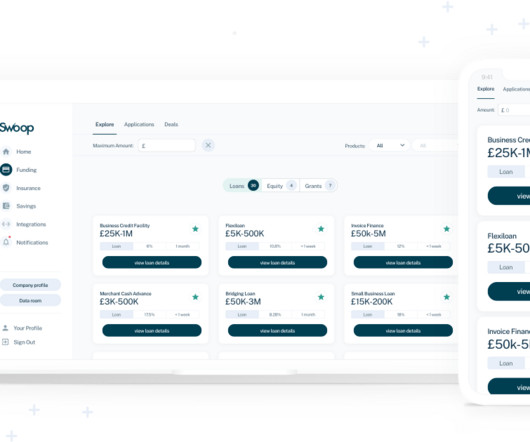

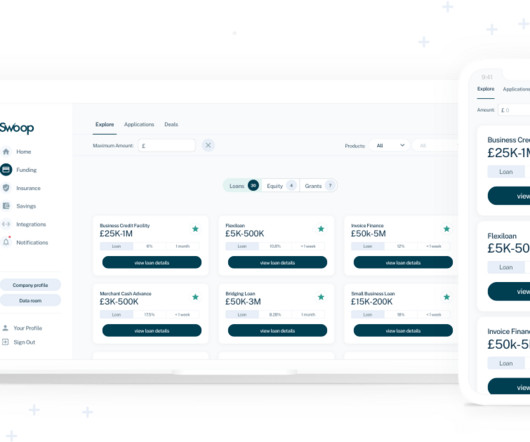

Swoop Funding

APRIL 17, 2025

Several financing options are available to help you buy a retiring business. SBA 7(a) loans – Backed by the Small Business Administration, SBA Loans are among the most popular options for business acquisitions. If you’re applying for an SBA loan, be prepared for more documentation.

Let's personalize your content