Loans to buy a retiring business

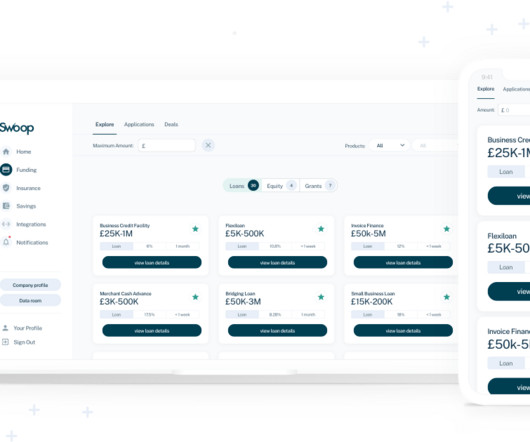

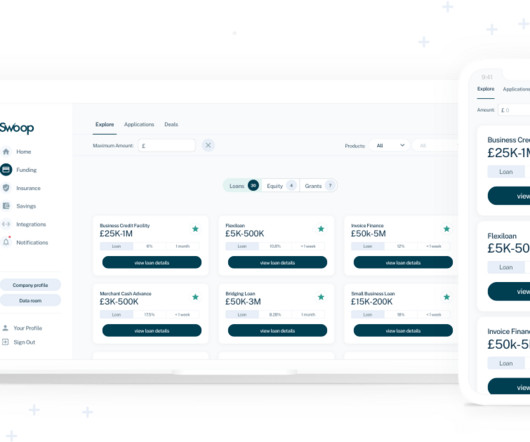

Swoop Funding

APRIL 17, 2025

Cons Upfront cost – Even with financing , acquisition requires capital for down payments, legal fees, and due diligence. Legacy issues – Inherited problems—like outdated systems, poor documentation, or staff turnover—can complicate the transition. If you’re applying for an SBA loan, be prepared for more documentation.

Let's personalize your content