7 Myths of Financing Your Franchise Business: Unveiling the Truth

Franchise Journal

FEBRUARY 1, 2024

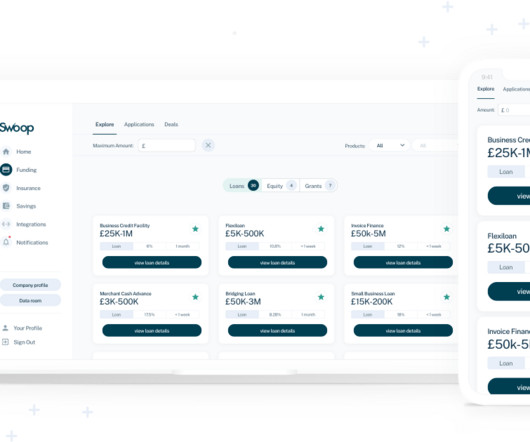

Let's debunk seven common myths surrounding the process of getting financing for a franchise business. Myth: Franchise Financing is Limited to Banks - Contrary to popular belief, franchise financing is not confined to traditional banks.

Let's personalize your content